Our vision is a Mississauga where everyone is food secure.

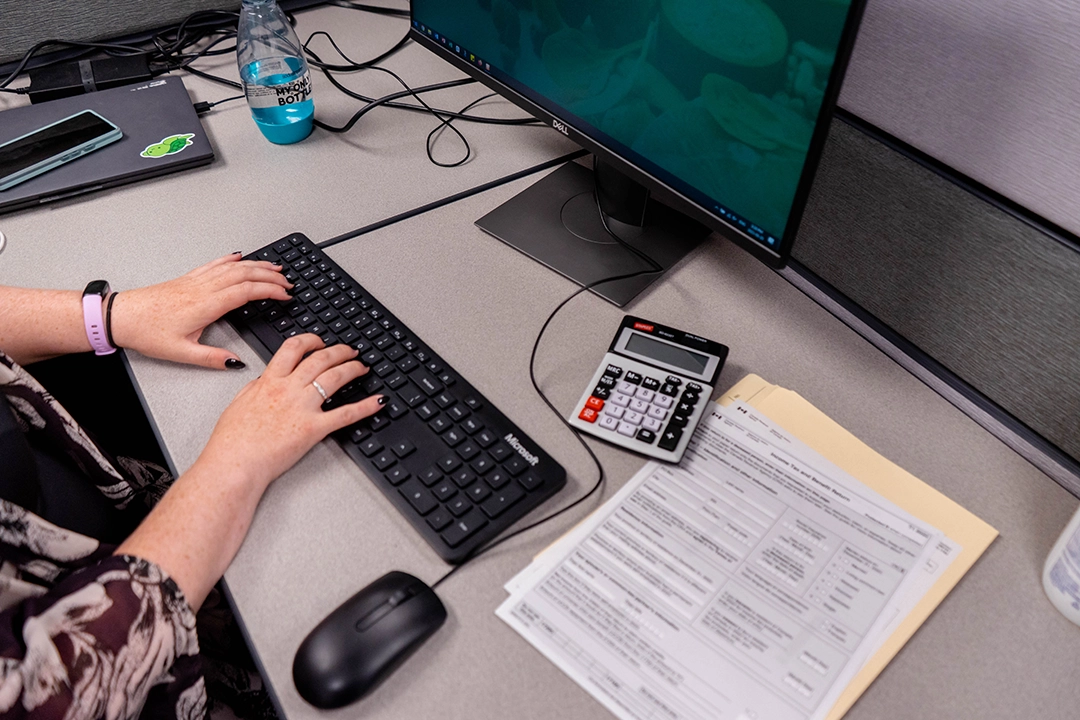

Save taxes, donate directly

When you donate publicly traded securities directly to Food Banks Mississauga, you eliminate the capital gains tax that you would pay if you sold the securities and donated the proceeds.

Give more, get more

Since capital gains taxes don’t apply, Food Banks Mississauga receives the full fair market value when the security is sold, and you get a tax receipt which reflects your larger contribution.

Questions?

We’re here to help! Check out our FAQ for more information on donating securities.

- Will I receive a tax receipt?

Yes, you will receive a tax receipt to the email address you provided shortly after making your donation.

- What do I do if I don't receive a tax receipt?

Please visit Canada Helps and request your tax receipt.